BTC Price Prediction: Technical and Fundamental Factors Point to Bullish Momentum

#BTC

- Technical Setup: MACD bullish crossover and Bollinger Band positioning suggest upside potential

- Institutional Demand: Corporate treasury movements create new baseline demand

- Supply Dynamics: Reduced profit-taking (91% supply) indicates holder conviction

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Upside

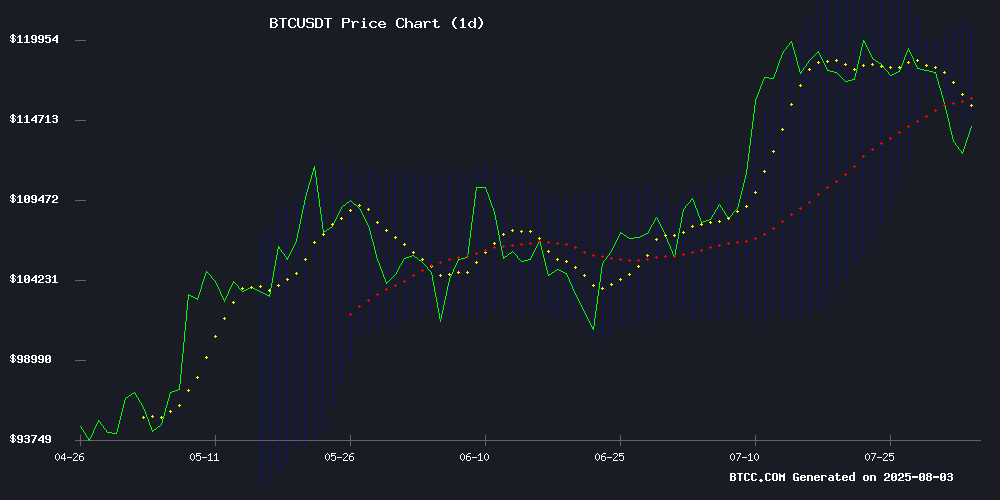

According to BTCC financial analyst Olivia, Bitcoin (BTC) is currently trading at, slightly below its 20-day moving average (MA) of. The MACD indicator shows bullish momentum with a positive histogram value of, suggesting potential upward movement. Bollinger Bands indicate BTC is near the lower band (), which could signal a buying opportunity if support holds.

Market Sentiment Mixed as Major News Events Impact BTC

BTCC analyst Olivia highlights several news catalysts influencing Bitcoin:anddemonstrate institutional adoption, while theandcreate short-term volatility. The reactivation of ancient wallets and declining profit supply () suggest long-term holders remain confident.

Factors Influencing BTC’s Price

Trump Media Confirms $2B Bitcoin Portfolio, Becomes Major U.S. Corporate Holder

Trump Media & Technology Group (Nasdaq: DJT) has disclosed a $2 billion Bitcoin portfolio in its Q2 2025 earnings report, positioning itself among the largest corporate holders of digital assets in the U.S. The company's financial assets now total $3.1 billion, marking its first positive operating cash flow.

The portfolio includes spot Bitcoin and a mix of BTC-related securities such as ETFs, trusts, and derivatives. These instruments provide price exposure without direct blockchain custody, catering to institutional preferences. Trump Media has also allocated $300 million to Bitcoin-linked options, which may convert to direct holdings based on market conditions.

This hybrid treasury strategy reflects growing institutional confidence in cryptocurrency as both a store of value and a yield-generating asset. The move signals deeper corporate adoption of Bitcoin amid evolving regulatory clarity and market infrastructure.

Statue Honoring Bitcoin Creator Satoshi Nakamoto Stolen in Lugano

Lugano's iconic Satoshi Nakamoto statue, a visual illusion created by Italian artist Valentina Picozzi, was stolen overnight. The artwork, unveiled in October 2024 as part of Lugano's push to become a Bitcoin hub, depicted Bitcoin's pseudonymous founder fading into code.

The theft was first reported by cryptocurrency commentator @Grittoshi, who speculated the statue may have been dumped in a nearby lake. Satoshigallery, Picozzi's artistic collective, has offered a 0.1 BTC bounty for information leading to its recovery. "You can steal our symbol but you will never be able to steal our souls," the group declared on X.

The incident follows Satoshigallery's recent unveiling of a third Nakamoto statue in Tokyo. The Lugano installation had become a focal point for Bitcoin enthusiasts since its debut at Plan B's Bitcoin forum, backed by Swiss-Tether's efforts to establish the city as a cryptocurrency center.

False Reports Circulate About New China Crypto Ban

Unverified claims of a renewed Bitcoin ban in China have spread across social media and select crypto news outlets. These reports recycle old news from Beijing's 2021 crackdown rather than reflecting any new regulatory action.

Chinese authorities maintain their longstanding prohibition on cryptocurrency trading and mining, with no recent policy changes. The confusion coincides with Beijing's exploration of a state-controlled stablecoin alternative to decentralized digital assets.

Market participants should note that China's regulatory stance remains consistent since its comprehensive 2021 restrictions. The yuan-backed stablecoin initiative signals continued government interest in blockchain technology despite opposition to uncontrolled crypto markets.

LuBian Mining Pool Suffers One of Bitcoin's Largest Heists: 127,426 BTC Stolen

Arkham Intelligence has uncovered a staggering theft from the LuBian Mining Pool, with 127,426 BTC—worth approximately $113,571 per coin at the time—vanishing in late December 2020. The Chinese mining pool, once commanding 6% of Bitcoin's global hash rate, saw over 90% of its holdings moved in a single transaction.

Analysts note that the attackers siphoned an additional $6 million in BTC and USDT two days later. LuBian's management reportedly scrambled to secure the remaining 11,886 BTC across multiple wallets. No official statements have emerged from either the pool operators or the perpetrators.

The heist's scale rivals historic crypto breaches, yet its discovery only surfaced through Arkham's blockchain forensics. Attempts to communicate with the thieves via wallet messages suggest a brazen, calculated operation rather than a typical security breach.

AIXA Miner Emerges as Top Choice for Bitcoin Cloud Mining in 2025

Cloud mining is experiencing a resurgence in 2025 as investors seek low-risk passive income streams amid evolving crypto regulations and Web3 adoption. AIXA Miner has positioned itself as the market leader by eliminating traditional mining barriers through its AI-driven platform.

The service's rapid adoption across North America, Asia, and Europe stems from its real-time mining benefits, daily payouts, and eco-friendly energy solutions. Unlike conventional mining operations that require specialized hardware and exorbitant energy costs, AIXA's cloud-based model offers accessibility without technical expertise.

Market trends show individual miners increasingly favoring cloud solutions over capital-intensive physical operations. AIXA's competitive edge lies in its regulatory compliance and incentive structures, including sign-up bonuses and stable payout mechanisms.

Bitcoin-Based Babylon Stake Protocol Gains Traction in DeFi Development

Babylon, a Bitcoin-based staking protocol launched in April, is rapidly emerging as a key player in decentralized finance (DeFi). Santiment data reveals the project ranks third in GitHub development activity among DeFi protocols, with 155.73 significant commits in the past month. This surge underscores growing developer confidence in Babylon's mission to address Bitcoin's programmability limitations.

The protocol aims to solve critical pain points for layer-2 projects built on Bitcoin, particularly around security and transaction finality. Its technical roadmap focuses on creating a more robust framework for Bitcoin-native financial applications. Such development intensity typically precedes major protocol upgrades and ecosystem expansion.

Market analysts note that sustained GitHub activity often correlates with long-term project viability. Babylon's rapid ascent in developer mindshare suggests the Bitcoin DeFi ecosystem may be entering a new phase of innovation. The protocol's progress bears watching as it could significantly expand use cases for the world's largest cryptocurrency.

Metaplanet Seeks $3.7 Billion to Expand Bitcoin Holdings

Metaplanet, a Japanese investment firm, is aggressively positioning itself in the Bitcoin market with plans to raise $3.7 billion through perpetual preferred shares. Shareholders will vote on the proposal at an upcoming extraordinary general meeting. The move follows the company's recent purchase of 780 BTC, signaling a strategic pivot toward digital assets.

The capital injection aims to bolster Metaplanet's Bitcoin reserves, capitalizing on institutional interest in cryptocurrency as a treasury asset. Management timed the initiative amid rising institutional adoption, mirroring broader market trends where corporations increasingly treat BTC as a balance sheet hedge.

This development comes as Bitcoin demonstrates renewed momentum, with traditional finance players and tech-adjacent firms allocating larger portions of their portfolios to crypto. Metaplanet's substantial commitment underscores the growing legitimacy of digital assets in global capital markets.

Ancient Bitcoin Addresses Spring Back to Life, Stirring Curiosity in Crypto Markets

Two long-dormant Bitcoin addresses, dating back to April 2010, have suddenly reactivated, transferring a combined $11.8 million worth of BTC. These addresses were created during Bitcoin's infancy when Satoshi Nakamoto was still active, and their revival has ignited speculation across the crypto community.

The first address received 50 BTC on April 18, 2010, when Bitcoin traded at $0.00547. At its latest transfer, BTC's price had surged to $118,707—a 2.17 billion percent gain. The second address, holding the same amount since April 26, 2010, saw an even more staggering 3.957 billion percent yield.

Their reappearance raises questions about the motives behind the moves. Were these early miners cashing out, or is there a deeper narrative tied to Bitcoin's enigmatic origins? The market watches closely, as such events often signal shifts in holder sentiment.

Bitcoin Profit Supply Drops to 91%—Swissblock Flags Critical Support Range

Bitcoin's supply in profit has retreated to 91%, down from recent unsustainable highs, according to Swissblock. The firm views this pullback as a potential healthy reset—but only if BTC maintains its $12.5K-$14K support zone. A breakdown below this level could trigger a tactical market shift, forcing traders into faster decision cycles.

Glassnode data shows BTC's profit supply metric cooling from January's 97% peak. Swissblock identifies this as a critical juncture for bullish continuation. Their @bitcoinvector clients have monitored this range for weeks, considering it pivotal for Q4 2025 trend sustainability.

The market now faces a binary outcome: holding support could reinforce bullish conviction, while failure may prompt defensive positioning. This comes as profit-taking accelerates amid weakening momentum—a historical precursor to deeper corrections.

How High Will BTC Price Go?

Olivia from BTCC suggests BTC could retest 120,000-121,267 USDT (upper Bollinger Band) if it breaks through the 20-day MA resistance. Key factors supporting this prediction:

| Indicator | Value | Implication |

|---|---|---|

| MACD | +1,885.97 | Bullish momentum |

| Bollinger %B | Near lower band | Oversold potential |

| Institutional Holdings | $5.7B+ new demand | Structural support |